At the start of the COVID-19 pandemic (April 2020) prices for all classes of sheep experienced drastic declines due to disruptions in lamb processing plants and traditional marketing outlets. However, a dramatic rebound and continued strength in sheep prices has created opportunity for sheep producers of all flock sizes. According to USDA estimates, approximately 93 percent of all 101,387 sheep operations in the U.S. are in the one to 99 head of sheep size category. In contrast, 70 percent of Wyoming sheep operations are in this category. Capitalizing on strong markets requires knowing where to access price reports for various classes of sheep, understanding seasonal/market timing and price changes and additional costs associated with market outlets.

Market data sources

The USDA-Agricultural Marketing Service (AMS) provides a valuable price discovery resource that summarizes daily sheep prices by auction location and reports the price for sheep weight classes and categories (feeder lamb, slaughter lambs, replacement ewes and slaughter ewes). Generally, all market locations and direct trading are summarized at the end of each week in one market report. Special replacement sheep reports of breeding age ewes, by age category, is usually provided the first week of each month. Whether selling direct to a buyer or planning on delivery to auction, USDA reports are the unbiased basis for negotiating prices. These USDA-AMS sheep specific reports can be accessed at https://bit.ly/USDA-AMS-Sheep.

Prices are reported per hundred weights (CWT) but can be easily converted to price per pound by dividing the price per hundred weights by 100. For example, if the USDA AMS price report states the slaughter ewe price per CWT is $128, simply divide $128 by 100 ($128 ÷ 100 = $1.28 per pound). Assuming the slaughter ewe weighs 160 lbs. the total revenue would be $204.80 (160 × $1.28). Additional deductions from the total amount may include a three to five percent commission on the total sale amount, yardage fee ($0.50 to $1.00 per head per day), insurance, vet inspection and $0.42 first handler assessment (lamb checkoff).

Costs to consider

The costs associated with transporting sheep to a market outlet should be calculated. This cost is based on the distance to market outlet, trailer size and number of sheep on trailer. This will range anywhere from $1.35 to $7.00 per loaded mile, according to regional custom livestock hauling rates. Coordinating with other sheep producers to optimize the number of sheep being hauled to market is a good strategy to cost‑share shipping expenses when there is still room on the trailer.

The animal weight loss from transportation often referred to as “shrink” is an additional cost not always accounted for. This weight loss is the result of manure and urine loss during transit. Research has determined the majority of “shrink” will occur in the first 12 hours of transport and will range from one to four percent in transportation less than six hours but can be as much as 6–12 percent for longer distance transportation. At current market prices ($2.20/lb.), a 90 lb. lamb with a four percent shrink during transport would be a $7.92 reduction in value before being sold. In these instances, coordinating with the sale outlet to house animals 24 to 48 prior to sale is a good strategy to allow lambs to reacclimate and re-gain any shrink.

Marketing options

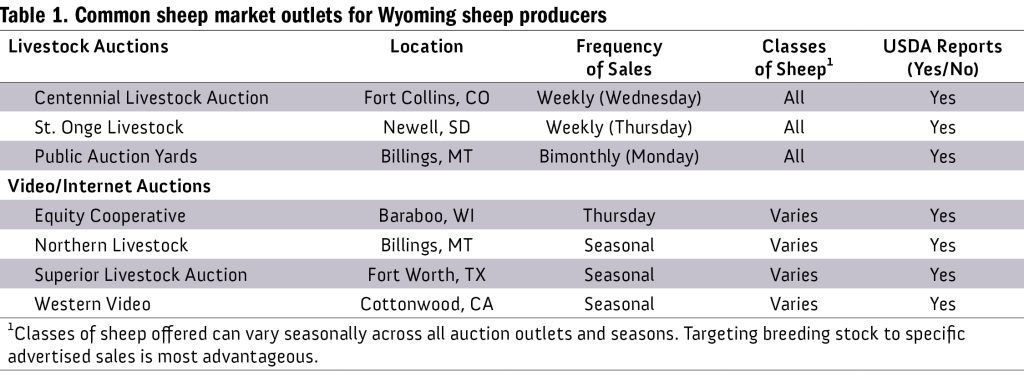

Negotiating prices directly with lamb feeders and processors has become more common, especially with larger operations. These marketing opportunities will range from a cash price on delivery to longer term negotiated contracts with price slides depending on weight of sheep. Maintaining relationships with your state and regional sheep industry association and neighboring producers can help keep you informed of these lesser-known marketing opportunities. See Table 1 for common sheep market outlets for Wyoming sheep producers.

Although auctions represent a common marketing strategy, private treaty sales and other direct marketing opportunities abound for smaller flocks especially with the help of social media. These opportunities are especially advantageous for smaller flocks with unique breed‑types and genetic quality that may not be valued at a larger auction outlet. Although recent policy changes have limited the ability of producers to market livestock through many social media platforms, there are still ways to indirectly advertise animals for sale. Where permissible, posting photos and accurate descriptions of sheep for sale on sheep production forums and state sheep associations can help attract interest from buyers. Additional follow-up correspondence regarding price and other logistics is best conducted directly between interested parties via phone or email. When directly selling, sellers and buyers do not have the same degree of protection from fraudulent parties and efforts to verify identity of buyer through a third party are advisable. Be wary of buyers that insist on wiring funds.

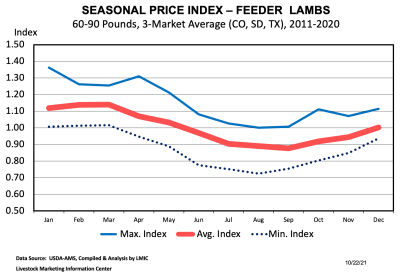

Historically, seasonal increases in demand for lamb can affect the price received for live-animal sales. The Christmas holiday and Easter markets have historically been periods where demand for lamb is highest for traditional marketing strategies. Ideal market timing for an individual producer is determined by a combination of price expectation and cost of production. The seasonal price index is a tool to help understand the relative price expectation part of the equation (see Figure 1). According to USDA data compiled by the Livestock Marketing Information Center there is an increase of six percent from August to November for 60 to 90 lb. lambs but a 22 percent increase from August to February. It is still critical, as an individual producer, to understand the differences in production costs associated with the different market timing decisions.

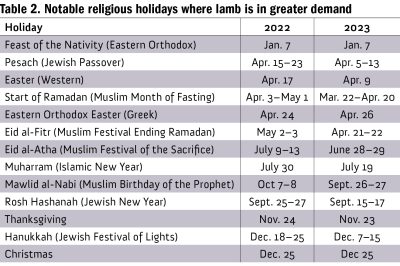

Like the “traditional” lamb market, the “ethnic market” is closely tied to a more specific set of religious holidays where lamb is frequently consumed. Timing the marketing of both ewes and lambs in advance of these specific holidays can often result in greater prices especially when located closer to larger ethnic communities (e.g., Denver metropolitan area). In addition to marketing strategies, adapting major on-farm production events such as lambing, weaning and culling of breeding stock around these holidays can be economically strategic. Remember that a strength of the ethnic market is the demand for all classes of sheep (e.g., older ewes and rams, ram lambs, undocked lambs) that may be discounted by traditional commodity marketing channels. Building networks with ethnic communities to determine what weights and classes of sheep they are looking for can further inform production strategies. Notable holidays tied to increased lamb prices and their calendar dates are listed in Table 2.

Ever changing market dynamics across a diverse sheep industry will continue to create challenges and opportunities. Even amidst the historically high sheep prices, a proactive marketing strategy is required. As costs of production continue to increase, strategic marketing strategies that maximize revenue per animal will become more important. Utilizing unbiased USDA data for price discovery, in addition to accounting for any added costs related to the various market options will also help keep producers in the driver’s seat. Emerging ethnic market opportunities that capitalize on market timing in advance of major holidays also can add value to smaller flocks in Wyoming and the surrounding region.

Whit Stewart is an Assistant Professor and University of Wyoming Extension sheep specialist. He can be contacted at whit.stewart@uwyo.edu or (307) 766-5374. Bridger Feuz is the University of Wyoming Extension interim associate director and is a livestock marketing specialist. He can be contacted at bmfeuz@uwyo.edu or (307) 783-0570.

Reprinted from Barnyards & Backyards magazine Spring 2022 issue.